Click here to see our most up-to-date market reports.

CONTENTS

Introduction

Probably everyone who works in or watches the e-cig industry has a vague sense of a sector driven by rapidly growing consumer demand, splintered by diverse technologies, threatened by regulation, and niggled at by medical doubts.

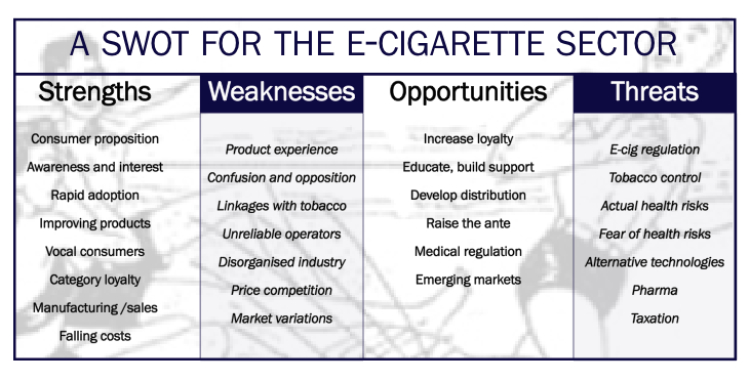

It remains to be seen which of these factors, and many others, will eventually dominate. So, to try to get them in perspective, the team at ECigIntelligence has drafted a SWOT analysis for the industry as a whole.

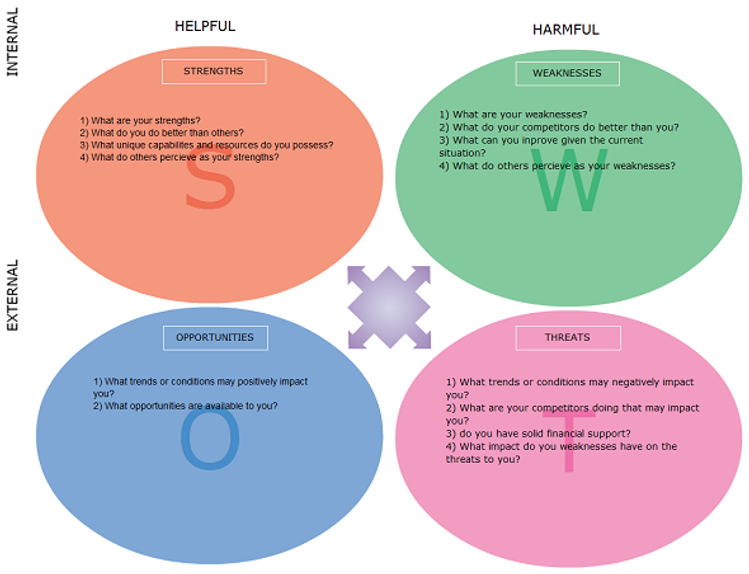

The SWOT – short for strengths, weaknesses, opportunities and threats – is a tool often used in business strategy to see beyond the immediate issues and identify the underlying forces that could lead to success or failure. Here’s an example of the questions a SWOT might ask and answer.

But where the example above is for a single business, it’s important to note that what we’ve tried to develop here is a SWOT for the e-cig industry as a whole – not for consumers, or for public health, though of course the industry’s fortunes are closely linked to the agendas of those communities too. Some factors may affect individual companies, regions, or sub-sectors in different ways…or not at all.

For example, while the (unlikely) emergence of strong scientific evidence that e-cigarettes are severely deleterious to health would impact on every corner of the business, other factors are not so universally applicable.

Regulations surrounding e-cigs can be burdensome in some countries, yet lightweight or even non-existent in others.

The fractured product and technology landscape arguably hampers the industry as a whole, because it means that the benefits and features of e-cigs are not universally understood by consumers in the way that, say, sunglasses are. But again there are many individual companies, thriving in their niches, unaffected by this.

So what would an e-cig industry SWOT look like? Here’s how we see it. These are our opinions and we welcome yours. If you agree, or think we’ve got it completely wrong, get in touch and let us know. You can, as always, leave comments at the end of this article.

Strengths

Consumer proposition

Self-evidently, the greatest force behind the growth of e-cigs is their compelling appeal to consumers. Put bluntly, the general perception is that they allow you to do something very like smoking cigarettes with almost none of the downsides; and if current science does not unequivocally confirm that, it does not raise obviously grave doubts either.

The biggest of the downsides that e-cigs help to avoid is, of course, ill health – and that is the heart of the proposition. The dangers associated with smoking tobacco are widely known (even if not always well-understood at the consumer level), but many smokers do not want to give up nicotine. Enter the e-cig.

This is supported by a host of secondary attractions, including the possibility of vaping in public places where smoking is banned, or doing it in a family or social environment where smoking may be unpopular, or saving money. But health is the big one.

Awareness and interest

For a very new product category with limited retail and advertising exposure (compared to some other fast-moving consumer goods [FMCG] categories), whose obvious appeal is limited to around 20% of the adult population in most countries (i.e. smokers), e-cigarettes have achieved remarkably high awareness.

In many of the largest e-cig markets in Europe and North America, awareness of the category is well above 90% among most age groups, with some at 100%. Intense media scrutiny of the sector (both positive and negative) in recent months can only have increased this.

And although awareness by individuals does not necessarily dispose them well toward e-cigs – it might do just the opposite – awareness among the population of potential buyers as a whole is a strength for most categories, simply because consumers unaware of a product category’s existence can hardly be expected to buy it.

Pedantic note: the exception would be where awareness is unanimously negative, but it is hard to think of commercial products (as opposed to, say, natural or social phenomena) where this is the case; the category would soon cease to exist.

Rapid adoption

Going hand-in-hand with the strengths of a compelling proposition and high awareness is the strength of rapid adoption.

It may not be an inevitable consequence of either (electric cars are a good example of a well-known, rarely-bought product), but where e-cigs are concerned it does seem to be the result.

Year-on-year growth rates are over 30% in most major world markets, and in some – particularly countries where the category has only been recently introduced – they are much higher.

Of course, this growth cannot continue infinitely: the practical upper limit is a certain percentage of the tobacco market (and one of the huge, unanswered – and for now maybe unanswerable – questions for the industry is just what that percentage might be).

But growth is an undoubted strength. It builds awareness and acceptance of the category, and funds activities from new product development to marketing, all of this contributing to further growth in a virtuous circle. It also makes it more politically difficult to regulate the sector out of existence.

Improving products

The industry continues to innovate rapidly – innovation that can be fuelled by the revenues from rapid growth, and enabled by the comparatively small size of most operators and the lack so far of complex regulatory product criteria or licensing requirements, though that seems likely to change in the key markets of the United States and EU, at least.

Quality improvements will doubtless also be driven in the near future by an increasing desire of consumers to understand and trust exactly what they are buying; the trend toward labels like “made in America” or “made in the UK” is one sign of this.

While for individual companies the object of innovation may be to increase market share or margins, for the industry as a whole it is a strength because it can improve the consumer proposition, starts to diminish the consumer dissatisfaction which we identify below as a major weakness, and makes the sector more responsive to any new opportunities or threats that may arise.

Falling costs

Lower costs make for a more flexible and resilient industry. Heftier margins can increase its attractiveness to investors, fund product development, and be shared with retailers to build channel loyalty. They can also be passed on to the consumer in the form of lower, or at least not-rising, prices.

Of course, stricter regulatory requirements can counter this by increasing costs; and the mainstreaming of the category may put further downward pressure on prices, undoing some of the benefit to margins that falling costs create.

Vocal consumers

Only an incurable optimist would contend that the e-cigarette industry’s powerful friends greatly outnumber its powerful foes. And we will argue later that the business itself is not as well-organised as it could be in making its voice heard. But it does have strong grassroots support, through organisations such as CASAA in the U.S. as well as a multitude of less formal, local groups and online forums.

Some of these groups liaise internationally, allowing the sharing of knowledge and strategic ideas. There is also a small but rapidly developing specialist consumer press, which will help to develop this sense of community.

Why is all this a strength? Because it helps to build category loyalty (more of which below) and encourages activism which counters some of the negative e-cig arguments in the public policy debate, even if only in a small way.

This strength can be overstated. The industry in its current form would not survive overwhelming regulatory opposition solely because of vocal consumers. But, given that even most e-cig opponents grant that there is a case to be made on both sides, they can help to tip the balance.

Category loyalty

We debated whether to include this as a strength at all. In the end we have done so, though with caveats.

Particularly at the tank end of the market, among more experienced e-cig users, there is high loyalty to the category as a whole (whether this is reflected in brand loyalty is another question, and one less important to a SWOT for the sector overall – though it seems likely that there is fairly strong brand loyalty in the tank subsector and far less for cigalikes, a fact acknowledged even by the Big Tobacco manufacturers).

In the most pronounced cases, a familiar sight is the “born again” vaper proclaiming that e-cigs have saved their lives and rather ironically joining with the sector’s strongest opponents in detestation of Big Tobacco.

It’s unlikely that they form a customer base large enough to sustain an extensive industry. But they do make up a reliable core, their identity and loyalty fostered (as we mentioned above) by groups, forums, media, vape stores, and even the slightly subversive associations of vape culture.

Perhaps more importantly, they are the heart of the politically influential consumer base discussed above, as well as active evangelists for e-cigs among their communities.

Ease of manufacturing and sales

Making and selling e-cigarettes should be relatively straightforward, at least where regulation and effective product design permits it to be. The underlying technology is not over-complex and manufacturing each new model does not have to not present substantial new engineering challenges.

Indeed, much manufacturing for western brands is contracted out to Chinese manufacturers who are essentially turning out the same core product with small points of difference. It is worth noting that tighter regulation (for example, requiring good manufacturing practices, or GMPs) might complicate this, albeit bringing some improvements to the manufacturing process as well.

E-cigs also have a range of attractions to the retailer and distributor, whose support is essential for the category to reach the mainstream; after all, it is very rare for a physical good (as opposed to a virtual good, like e-books) to make a major impact purely through online sales.

They are compact and relatively lightweight with a high value-to-bulk ratio. They are not perishable or fragile, or difficult to display. In the case of cigalikes, at least, they don’t require time-consuming explanation to the customer or after-sales service; while both cigalikes and supplies of e-liquid for tank systems are frequent, repeat purchases.

Moreover, where cigalikes are concerned, tobacco counters provide a ready-made, highly visible display opportunity that immediately makes the proposition clear to the shopper. And at the other end of the e-cig industry, vape stores can flourish by fostering consumer desire for personalisation and the feeling of belonging to a select club of insiders.

Regulation – for example, prohibiting sale to minors, or limiting point-of-sale marketing activity – can be a slight headache for stores. But it is no more than they have to contend with on a range of other profitable categories, notably tobacco and alcohol, and margins for e-cigs can be higher than for tobacco. The bulk of any regulatory hassle is borne by the brand owner.

So far, so good for the e-cig sector. But what are its weaknesses?

Weaknesses

Product experience

While the consumer proposition for e-cigs – the ideal – is compelling and one of the sector’s biggest strengths, the reality does not always live up to it. Particularly at the cigalike end of the market, many users find that e-cigs do not deliver the same satisfaction as combustible tobacco, and some of them drop back to using combustibles.

The reasons for this are not entirely clear, but probably include the way that the nicotine is delivered as well as the actual quantity of nicotine obtained per puff. Wide-ranging variance in the true nicotine concentration of e-cigs and e-liquids supposedly at the same level is well-documented. Poor maintenance of tank systems can lead to diminished battery power and nicotine output, leakage, bitterness, and so on.

All this is a weakness not only because it can diminish the pool of current buyers, but it also creates among smokers a group of “never-again vapers” who will be difficult to lure back to the category even when products do improve. The word of mouth they spread will not be positive either.

Innovation and better manufacturing practices (whether required by regulation or not) will help to correct this, and if the e-cig market follows the pattern of most novel categories by consolidating into a smaller number of larger brands, that is also likely to improve product reliability and consistency.

Consumer confusion

Consumers – even non-smokers – are highly aware of e-cigs, and we consider that a strength. But when it comes down to the details, what they are actually aware of may be a muddle of misconceptions. Anecdotally, at least, it seems non-vaping consumers are often in the dark about the health implications of the category, its regulatory situation, and even its essential non-tobacco nature.

Part of the problem, of course, is that on some questions – notably in health – the experts are neither in unison nor wholly decided. Also contributing to this confusion is what amounts to propaganda from anti-e-cig activists, and a lack of co-ordinated public relations response to it from the industry or those sympathetic to vaping from a public health standpoint.

Misleading or critical media coverage, meanwhile, is both a symptom and a cause of this wide lack of understanding – and can be more than an irritant: for example, we believe it to have been a significant factor in the shrinking of the Spanish market. Understanding of e-cigs is also affected by the mistrust of novel technologies that mars some news reporting, for example in the spate of stories on fires, pet poisonings, and the like.

Policy-maker/thought leader confusion and opposition

The main effects of consumer confusion are that it may prevent some individuals converting from smoking to vaping, or prompt unnecessary e-cig bans in private businesses. Perhaps more threatening to the overall sector is a lack of understanding or downright opposition – and it is not always easy to tell where one starts and the other ends – in policy-making and other influential circles.

This is partly down to the same factors as consumer confusion. But more often than not there is one big issue lurking behind it…

Linkages with tobacco

At least where regulation is concerned, linkages – whether real or perceived – with tobacco and the tobacco industry are the overwhelming weakness of the e-cigarette sector. E-cigs are regarded by many in positions of power and influence as tobacco products, or relatives so close that the distinction is unimportant, or gateway products that will lead non-smoking consumers toward combustible cigarettes.

The industry is also often perceived as being driven by Big Tobacco, which is true only to a limited extent, and a further significant negative is the widespread confusion between relatively benign nicotine and the much more harmful components of tobacco smoke.

And so the deep opposition to tobacco products and the industry that produces them, sometimes genuine and sometimes politically motivated, is applied to e-cigs – a tendency reflected in regulation and proposed regulation which we have reported on extensively, from Canada to India.

The “gateway to smoking” hypothesis, meanwhile, may well fall foul of most of the statistical evidence as well as common-sense objections, but it is nevertheless a belief that cannot be ignored. It is directly behind regulatory ideas such as setting minimum ages for e-cig purchase (with which few in the industry would disagree) and bans on flavours (which many argue with).

How to counter it is, moreover, a thorny problem for the sector. A principle of most anti-tobacco positions (notably that of the World Health Organization, or WHO) is that the arguments of the tobacco industry will not be taken into account – indeed, to that extent there is no “tobacco debate”. So, if e-cigs are defined prima facie as tobacco products, from the tobacco industry…how can they be persuasively defended?

This is no academic point: the WHO could have consulted with independent e-cig makers or associations before formulating its policy position at the recent FCTC COP6 meeting in Moscow; its self-imposed prohibition on dealing with the tobacco industry does not prevent that; but it did not do so.

Unreliable operators

A voguish new industry with a low cost of entry, such as e-cigarettes, inevitably attracts entrepreneurs with little long-term commitment to the sector, quality product, customer service or investment. (One fairly obvious symptom of this is the quantity of junk email from online e-cig vendors.)

Customer dissatisfaction is the inevitable result, and the results of it are similar to those caused by poor and inconsistent product, the first weakness on our list.

But the problem here goes further than unhappy customers. If the industry as a whole is tarnished by these operators, and confidence in it undermined, this can also negatively affect the attitude of many other influential players including the media, potential financial backers, regulators and enforcement agencies.

Disorganised industry

We identified organised consumer support as a strength, albeit a minor one, of the e-cig sector. But despite a few high-profile trade associations, the industry itself is not well-organised in many territories. (Even those associations that are making a difference are frequently very new.)

There are also internal differences; cigalike manufacturers, for instance, may have a vested interest in encouraging regulation that creates difficulties for tank systems, such as through imposition of flavour restrictions and nicotine concentration limits.

This makes it hard for a coherent industry voice to be heard where it matters, especially when dealing with regulators and the media. Moreover, where there is a voice, it is rarely representative of the whole sector and tends toward the independent brand/vape shop end of the market – not a bad thing in itself, but one that further contributes to mixed messages and incomprehension.

On the plus side, those organisations that are active and efficient (and form international links with their counterparts) can help to develop understanding of the category and the sector among policy-makers, as can professional media and events such as conferences. We believe that a large portion of the opposition to e-cigs derives from misconceptions of lack of information, so this can only help.

And the positive impact of industry organisations is developing rapidly, for example through the involvement in setting standards of groups such as AEMSA in the U.S., FIVAPE and AFNOR in France, and ECITA in the UK.

Price competition

The sheer number of e-cig brands available, the inability of most operators to invest heavily in brand-building, and the lack of very clear product differentiation (certainly at the cigalike end) leads companies to compete on price.

This may increase consumer appeal to some extent, but it has negative effects for the industry too – the opposite of the strengths created by falling costs, which we discussed above. Reduced margins decrease the funds available for product innovation and marketing, perpetuating the cycle of price-cutting as companies find it difficult to differentiate in more original ways. Or they could mean a reduction in retail margins, reducing retailers’ willingness to give optimum exposure and sales effort to the category.

Price competition may also make some customers liable to shop largely on that basis, encouraging them toward inferior products and ultimately decreasing consumer satisfaction.

Market variations

As numerous ECigIntelligence territory reports show, the e-cig market is very different from one country to another. For example, the cigalikes that make up a substantial portion of sales in the UK are far less popular a short distance away in Spain. The manifold reasons include regulation, tobacco smoking cultures, and retail channel structures.

This is not a terrible weakness. After all, one of the biggest of all the world’s consumer segments – food and beverage – is famed for its regional quirks, and indeed the tobacco market differs considerably from one country to the next.

But it does make it harder for super-large brands to emerge, with all the marketing clout and product innovation resources that they can wield – not to mention the cash to jump through regulatory hoops where required. Indeed, for smaller brands the very high expense of entering crowded e-cig markets such as the UK may already be prohibitive anyway.

This in turn feeds into a number of the other weaknesses we have mentioned above.

We’ll look now at the opportunities and threats facing the e-cig industry. These sections are necessarily more speculative than the preceding two – but your perspective can help illuminate them, so please do let us know what you think using the comment facility on this (and every) article.

Opportunities

Increase loyalty and adoption

The appealing proposition is clearly there, and consumers are aware of it. So the stage is largely set for building up adoption and loyalty.

Significant product enhancements will help further, and are likely. In some areas, for example improvements to batteries, e-cigs are the beneficiaries of more general innovation. In others, better understanding of the vaping experience is enabling product improvements, as is the market shift away from cigalikes toward tank systems, said by many vapers to be more satisfying (although there is still a question mark over whether e-cigs can ever be as satisfying as tobacco cigarettes for all users).

Product innovation should help to improve loyalty among those who already vape. Where non-vaping smokers are concerned, the missing link is probably effective marketing both of the category and of individual brands. Regulation may curtail some above-the-line marketing investment, in particular, but there is surely a good chance to connect latent demand with better awareness and more opportunities to buy.

All this represents a major opportunity to build on the sector’s core strengths and thus increase both loyalty among existing vapers and adoption among current smokers.

In the same vein, the industry can…

Educate and build support

A more organised industry can use the core strengths as a foundation for educating and creating support among non-smokers, policy-makers and thought leaders.

Where policy-makers and thought leaders are concerned, the benefits of realising this opportunity are two-fold: create positively favourable conditions for e-cigs, for example by their being recognised in public health as a preferable alternative to combustible tobacco; and diminish negative regulatory tendencies. The two go hand-in-hand, of course.

Why are non-smokers on this list, though? Not because the e-cig industry has any great opportunity or ambition to “convert” them, but because their views matter. They matter in policy formation because they are the majority: they mostly won’t be interested enough to vote deliberately in favour of kinder regulatory regimes for e-cigs, but if they are sympathetic to the product they won’t be activist antis either, and their sympathy will be heard through opinion polls.

Plus, non-smokers are the family, friends, colleagues and bosses of potential vapers, and inevitably affect their views.

Develop retail and distribution

Seizing the opportunities we’ve already discussed can, in turn, help the industry improve its presence and standing in the marketplace through heightened retailer support and the development of new channels.

More customers, more visible and coherent marketing, less vehement controversy, gentler regulation: all will be persuasive to retailers and earn e-cigs better exposure on the shelves (real or virtual). This can create another virtuous circle, with sales increasing and other benefits flowing from that – further retail commitment, more marketing funds, deeper investment in developing better product.

Raise the ante

We don’t believe that most vapers want to shop primarily on price. (Their wallets are already much better off merely for replacing combustibles with e-cigarettes.)

We therefore think that, all other things being equal (including – very importantly – retail availability), the market will tend toward the better products – “better” being somewhat subjective, of course, but including factors such as ease of use and effective nicotine delivery.

What this boils down to is that investment in product improvements supported by investment in marketing will, eventually, force the less satisfactory or responsible brands to either up their game or exit the market. At the least it will decrease their share, and any of these outcomes will counteract the “unreliable operators” weakness.

Medical regulation

The compulsory licensing of e-cigarettes as pharmaceuticals or quasi-pharmaceuticals is usually seen as a threat, because of the very high cost of compliance and the possibility that it will limit retail availability. But optional licensing – something that EU member states will be able to allow under the new Tobacco Products Directive (TPD), for example – could be a positive opportunity.

The devil here would be in the regulatory detail, but there are certainly several benefits that could flow from it for the industry as a whole. Not only the licensed brands, but the overall e-cig concept, would gain an implicit stamp of medical approval, bolstering confidence among consumers and support in health professions. Licensing would also, in many regimes, allow health benefits of e-cigs to be spelled out in advertising.

At the same time, the manufacturers of non-licensed products might be encouraged to improve them to near-pharma standards in order to compete, even if they do not actually pursue a licence.

Emerging markets

These markets – and their educated, aspirational middle classes especially – are an opportunity for most FMCG categories as consumers in them grow more affluent and urbanised, populations continue to swell, and retailing becomes more sophisticated.

The e-cigarette sector is no exception but there is an additional factor here: the sometimes very different patterns of tobacco consumption and control between the developed world and the Global South.

As a very broad generalisation with numerous exceptions, smoking prevalence is higher in the emerging markets and tobacco control is looser. At the same time, populations are often growing so rapidly that the total tobacco market can grow in these countries even if there is a decline in prevalence. In other words, even if a smaller proportion of the population is smoking year by year, the total number of smokers continues to build.

As long as tobacco control and associated health education are limited in these markets, the consumer proposition for e-cigs may be weaker than in the developed countries, and they may remain a niche gadget for the well-off. However, even where tobacco control is weak the tendency is to strengthen it (sometimes quite rapidly and dramatically from a low starting point, as in India and China at the moment).

This could work in favour of e-cigarettes provided that consumer affluence and more organised retail are in place. The big caveat with this potential opportunity, however, is that – India again being a case in point – the e-cig baby could be thrown out with the tobacco bathwater, if tightening tobacco controls either deliberately or inadvertently limits the marketability of e-cigarettes too.

Threats

E-cig-specific regulation

Nearly all regulation framed for e-cigs places limits on what the industry can legally do, or imposes burdens on it in achieving that.

Regulatory measures that actively change the status quo in favour of e-cigs, for example the recent liberalisation of British advertising rules, are few and far between. (It can, though, be argued – as we do above – that allowing voluntary pharmaceutical licensing is an example of regulation positively to the sector’s advantage, even if not intended that way.)

However, this is true of most industries. Limiting and imposing burdens is what regulation largely does. The exceptional regulatory threat facing e-cigarettes is prohibition, very unlikely to happen globally, but quite plausible in individual countries – indeed already implemented, explicitly or de facto, in some.

Falling short of that, but still threatening enough, is the possibility of product limitations so severe that they substantially dilute the consumer proposition (the EU’s TPD may prove to be an example), and/or licensing/approval measures so burdensome that they make it difficult for the sector to supply a wide range of products and innovations at a cost the market can bear (one of the main concerns with the proposed deeming regulations of the U.S. Food and Drug Administration, or FDA).

On the plus side, regulation as quasi-tobacco or a consumer good may help to improve consumer confidence and raise standards, while not imposing requirements as onerous as pharmaceutical regulation.

But the risk for the sector is double-edged. Not only may some regulators set out deliberately to stifle the growth of e-cigarettes. The product can also fall victim to…

Tobacco control

Collateral damage from tobacco control may even be the larger threat. There is virtually no government that does not at least pay lip service to anti-tobacco measures, and many are very active; a significant international agreement, the WHO’s Framework Convention on Tobacco Control (WHO FCTC), mandates it for most countries.

Unfortunately for the e-cig sector, this real and well-funded commitment to tobacco control often takes in e-cigarettes as well, either intentionally or by oversight.

Although there is a good argument that e-cigs are not “tobacco products” they are often treated as such by regulation (partly because of the nicotine/tobacco confusion we mentioned above), and there is little political will to argue against that – little will, indeed, to say anything that might smack of sympathy for tobacco.

Sometimes, perhaps, there is also a political desire to score a relatively easy “tobacco control victory” over e-cigs. In the extreme case, it is much more achievable to ban them than to eliminate smoking.)

In any case, it is inconceivable that tobacco control will diminish and very likely that it will accelerate, so this threat is not going away.

Moreover, it is not just in the regulatory field that e-cigs face collateral damage from tobacco. The association can harm consumer perceptions too, and those of businesses – for example, there is a trend for retailers (such as CVS in the U.S.) to stop stocking tobacco products, and it is quite plausible that some making that decision would drop e-cigs too.

Fear of health risks

Distinct from the emergence of actual, substantiated health risks, fear is a threat because it too can undermine the consumer proposition and lead to restrictive regulation.

We don’t think it is affecting consumer perceptions at the moment, at least on any large scale – the health comparison with tobacco is simply too positive – but there are indications that it has been growing, and there have already been cases, for example in Spain, where negative media coverage of e-cigs’ health effects has seemed to have an effect on the market.

It is certainly already happening in regulation, albeit more often with a public health than an individual health rationale (notably, the various ways in which e-cigarette use is believed to encourage or perpetuate use of combustibles – the “gateway effect”, re-normalisation of smoking, and so on).

Actual health risks

Although the science is far from complete, there seems no reason at the moment to imagine that e-cigs pose any risks to individual health remotely comparable with tobacco’s. But no contemplation of threats to the industry would be complete without considering this possibility.

If a significant health risk – which could still fall well below that of tobacco – were to emerge, it would devastate the consumer proposition and greatly increase the urgency and strictness of regulation. Other health concerns, even those unrelated to whatever discovery was made, would spiral beyond amelioration.

It is doubtful whether much of an e-cig industry would survive; even with product modifications to remove the risk, the damage would be permanent, and it would likely remain no more than an obscure hobbyist area, at least for many years.

Alternative technologies

Other smokeless nicotine delivery systems are already on or approaching the market, for example Ploom; Voke, from the British American Tobacco (BAT) subsidiary Nicoventures; and heat-not-burn technology from Philip Morris International (PMI). It seems obvious that these will occupy at least some of the market spaces currently served by e-cigs, and if they or their successors are better products, they may well displace the e-cigarette.

The equally obvious riposte to this threat is that the e-cigarette industry itself can also produce alternative, better technologies – or greatly improved e-cigs, amounting to the same thing. But given that the alternatives are mostly coming from big players with pockets far deeper than the independent e-cig firms, and that any novel underlying technologies are likely to be heavily patent-protected, that may be easier said than done.

This development, if it takes place, may well not be a mortal “threat”. It could even have benefits for the e-cig industry – for example, if the well-resourced suppliers of other smokeless systems fund scientific research that demonstrates conclusively their safety or efficacy in smoking cessation. But at the least, it threatens radical change.

Pharma

The pharmaceutical industry is the e-cig sector’s equivalent of Sherlock Holmes’s dog that did not bark in the night – frequently spoken of as an obvious entrant, yet notable by its absence. One explanation may be the very long product development cycles (and subsequent payback periods) to which pharma is accustomed, and which it is happy to fund.

The threat here for the existing e-cig sector is that pharma – better-resourced than the e-cig independents, free of the taint of Big Tobacco, familiar with medical licensing requirements, and powerful in the channels where those licensed products are sold – could muscle in, persuade regulators that only it can deliver safely on the public health benefits of e-cigarettes, and encourage compulsory licensing regimes.

The existing e-cig business would not disappear overnight, but would have to contend with strong new opposition on a field highly favourable to pharma.

However, it is far from a foregone conclusion that pharma would be able to pull this off. The more that time passes, the clearer it will be that for many users e-cigs are a permanent alternative source of nicotine, rather than a cessation aid. Making the case that they are medical products will then be tough.

Additionally, unlike the tobacco industry, the pharma sector can probably not just buy in e-cig products and start to market them: to obtain the medical licensing that would be its edge, it would need to develop them as pharmaceuticals from scratch.

Taxation

Finally, e-cig-specific taxation is a threat to the industry’s sustainability, and a real one particularly because of the political acceptance of high tobacco taxes.

In other words, arguing against an e-cig tax can mean arguing the whole contentious case for e-cigs’ superiority to tobacco: to win the tax argument, the industry often has to win the health argument, where (as we’ve discussed) it has many political foes.

Although taxes specific to this category are still relatively uncommon, there is a pronounced if slow movement toward them, reducing the price attractiveness of e-cigs compared with tobacco and/or putting heavy pressure on margins. We have said that we do not believe consumers switch to e-cigs for purely financial reasons, but they must have been a factor in the rapidity of take-up.

The benefit that taxation does bring is that it makes prohibition, or sharp tightening of controls, less likely. The existence of a tax regime implicitly endorses the category. However, whether this sense of security is – for the industry – worth bearing a high tax rate is another question.

– Barnaby Page ECigIntelligence staff

The author

Barnaby Page, editorial director, ECigIntelligence. Barnaby is a journalist with 30 years’ experience including senior roles at TechWeb.com, Screen Media Magazine, and Casino International; he has been a reporter and editor on numerous magazines and broadsheet newspapers in Britain, Canada and the Middle East, specialising in business, technology/innovation, marketing and regulation.

SWOT template graphic: Creately.com