Traffic to the leading online e-cigarette retailers in the US has become more concentrated on the leading websites, according to an ECigIntelligence market report.

Traffic to the leading online e-cigarette retailers in the US has become more concentrated on the leading websites, according to an ECigIntelligence market report.

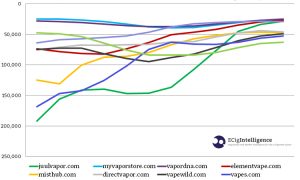

Over the last two years, website visits to these retailers have clotted, with the top half of visits to the top 20 sites being shared among seven sites in 2015 and only five in 2017.

Nevertheless, there was relatively little turbulence in the top ranks, with higher performers keeping their ratings while lower performers shuffled around.

Notably, the amount of direct traffic to these sites has considerably decreased, while those coming from organic search via search engines has increased.

The top-ranking sites are more likely to be multi-brand than single-brand sellers. However, the top single-brand site, juulvapor.com, pulled in 490,000 unique monthly visitors in June 2017, while myvaporstore.com, the top ranking multi-brand site, had 390,000

The top-ranked sites also tend to offer a wider range of hardware products.

Visit distribution in the US is similar to that in the UK, but markedly different from other countries, such as France.

“There are no clear behavioural differences between visitors of better and less well performing sites. More page views per visit or longer time spent on the site can be the sign of more engaging content but also of less efficient, more time-consuming site navigation or checkout process,” the report says.

Top sites also tended to have more social media activity, but this is not without exceptions and qualifications.

What This Means: The concentration of online visits among a smaller number of top-performing websites may reveal a settling of the online e-cigarette market in the US.

This apparent trend, outlined in our detailed traffic report, is likely to be redoubled if the decline in direct traffic in favour of organic search continues.