An ECigIntelligence survey of US vape stores found that while monthly revenues have remained at the same level as they were in 2016, a lower proportion is now generated by the sale of e-liquids, with mods and starter kits showing a significant increase in sales.

An ECigIntelligence survey of US vape stores found that while monthly revenues have remained at the same level as they were in 2016, a lower proportion is now generated by the sale of e-liquids, with mods and starter kits showing a significant increase in sales.

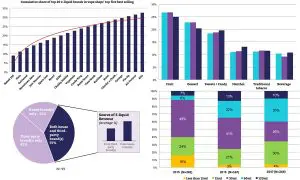

The survey of 1003 stores, carried out in July and August 2017, found that the average number of e-liquid bottles sold had not changed, although the popularity of 15ml and 60ml bottles had increased.

There was no significant change in the popularity of nicotine strength and flavours: 30mg/ml remains the most popular strength e-liquid, with fruit the most popular type of flavour.

There has been an increase in the number of stores that sell only in-house branded e-liquids, which generally sell better than third party brands in stores that sell both.

Naked 100 has shot up dramatically since 2016 to become by far the most popular e-liquid brand.

The announcement by the Food and Drug Administration (FDA) that it was relaxing immediate requirements under the deeming regulations caused the vast majority of respondents to declare a very optimistic view of the industry, up 25% on the number before the announcement.