California is putting forward a budget proposal that would increase taxes on vapour products in the next fiscal year and promises to work on a statewide flavour ban.

California is putting forward a budget proposal that would increase taxes on vapour products in the next fiscal year and promises to work on a statewide flavour ban.

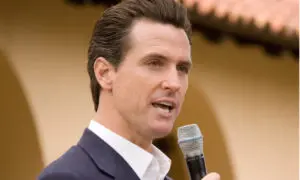

Democrat governor Gavin Newsom (pictured) included the tax increase in his 2020-2021 revised budget proposal released earlier in the month. The measures had previously been included in Newsom’s initial budget proposal in January.

The measures are necessary “to address the rapidly increasing youth use of potent nicotine-based vaping products,” reads the budget proposal’s summary.

Under the governor’s plan, the US state would add a $2 tax on every 40 mg of nicotine in vaping products from 1st January 2021. This would be in addition to existing taxes.

Newsom’s office says it would also use $7m of the money raised by the tax increase to create a new task force led by the California Highway Patrol “dedicated to combating the underground market for vaping products”.

The task force, comprised of ten Highway Patrol investigators, would be designed to intercept illicit imported and domestically manufactured vaping devices and products.

State flavour ban

A memo on the budget proposal also says that illicit vapour products pose a public health risk and likely also take business away from licensed vapour companies.

In addition to the tax increase, Newsom’s budget noted his administration “will support a statewide ban on all flavoured nicotine products as of January 1, 2021”.

The note is an endorsement of a flavour ban proposal such as the one put forward by state lawmakers led by Democrat senator Jerry Hill. Senate Bill 793 would make it illegal for a store to sell flavoured e-liquids and tobacco products, including menthol. The bill is set for a hearing at the Senate Appropriations Committee on 1st June.

A similar bill made progress in the state legislature last year but support fell apart as amendments were added.

Staying afloat

The proposals were cheered by vaping critics but mourned by the industry.

The Campaign for Tobacco-Free Kids said it “strongly supports” the governor’s efforts, which it said will make it more difficult for children to access vaping products, especially flavoured ones.

“We need to rid the market of these products,” the group told ECigIntelligence. “In addition, tobacco taxes have proven to be a highly effective way to reduce the use of tobacco products, especially among price-sensitive kids.”

However, analysis by the Tax Foundation, a think tank based in Washington DC found that the tax increase might incentivise vapers to use traditional cigarettes instead of certain vapour products, and considered that “this inconsistency goes against the concept of harm reduction”.

Vapour advocates have unsuccessfully fought similar measures, including flavour bans in Massachusetts, Rhode Island, New York, and New Jersey. They worry that the impact of a flavour ban on California businesses would be severe.

“In the wake of COVID-19, small businesses in California are struggling to stay afloat and jobs are at a premium,” Tony Abboud, executive director of the Vapor Technology Association, told ECigIntelligence. “Making legal products more expensive and more inaccessible for these adults will create the very black market that the proposal tries to protect against.”

What This Means: According to official estimates, the new vaping tax in California is expected to raise $33m in its first year.

Now it is the turn of the lawmakers, who will need to vote on the content of the budget proposal by June. Both chambers have Democratic majorities, so it is expected that the legislative process will be rather easy.

California is not the only state putting forward tax increases for e-cigarettes. In Virginia, Republican governor Ralph Northam signed in House Bill 30, the state budget that imposes a $0.066 per ml tax on liquid nicotine for taxable sales or purchases occurring on and after 1st July.

– Julian Hattem ECigIntelligence US states correspondent

Photo: Wikimedia Commons