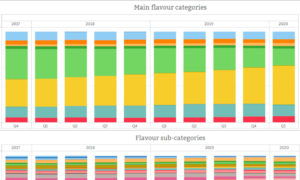

US vapers are becoming increasingly drawn to fruit flavours. The category has been steadily overhauling other flavour types for the past two years and in the first quarter of 2020 it accounted for more than 40% of all e-liquids tracked by ECigIntelligence for our newly launched US flavours tracker.

US vapers are becoming increasingly drawn to fruit flavours. The category has been steadily overhauling other flavour types for the past two years and in the first quarter of 2020 it accounted for more than 40% of all e-liquids tracked by ECigIntelligence for our newly launched US flavours tracker.

At the same time, we have observed a general decrease in the complexity of flavours, as simpler flavour profiles have gained ground at the expense of those with multiple components.

This is particularly notable with pre-filled pods, 28% of which were tobacco-flavoured in Q1 2020.

By contrast, only 7% of disposables had a tobacco flavour (almost the same as for bottled e-liquids), while 69% were fruity.

There is a marked polarisation in the tobacco category, with both single-component tobacco flavours and the most complex (tobacco plus dessert/beverage mixtures) gaining momentum.

Fuller details of these and many other aspects of the complex and constantly shifting pattern of flavours on the US market can be found and examined in our tracker – which will be followed by others examining the markets in the UK, France, Germany, Russia, Italy and Canada.

Impact of regulations and demand

ECigIntelligence managing director Tim Phillips said: “We regularly carry out surveys on vape consumers, manufacturers and retailers, and have been providing data based on relatively small sample sizes on flavour and nicotine preferences globally for years. But this is the first time we have been able to track in detail the changing flavour and nicotine characteristics of products offered in the leading vape markets.

“Although these data are limited to products offered by leading online retailers, they provide a strong proxy for consumer demand and sales volumes in a sector which is traditionally very difficult to track.

“Online data is becoming more and more relevant as COVID-19 accelerates the shift online. It is exciting to finally be in a position to analyse detailed longitudinal changes over a period of more than two years from hundreds of thousands of data points, and demonstrate the impact that different regulations and consumer demand have had in each market.

“Particularly given the controversy surrounding flavoured products and nicotine strengths, these data provide clear historical trends and competitor benchmarking, and allow detailed analysis on likely future scenarios given the changing regulatory landscapes we expect around the world.”

What’s in the box

Based entirely on ECigIntelligence’s own data collection and in-house analysis, the flavour trackers include:

- Flavour profiles divided into 11 categories and 47 sub-categories

- Flavour analysis of products carried by leading websites

- The evolution of the number of products in flavour categories by nicotine type

- Flavour mix of products from the top brands carried by websites

- Flavour analysis of new products compared to the previous quarter

- Flavour profiles per brand, flavour components and the evolution of the most popular flavours since 2017.

Available as an add-on to any of our subscription plans, these highly interactive trackers will enable users to identify and compare the leading brands in each market, understand product evolution and trends, and gain detailed insight into consumer preferences.

See here for further details and a trial version.

– ECigIntelligence staff